Yes! You can use AI to fill out Form 1065, U.S. Return of Partnership Income

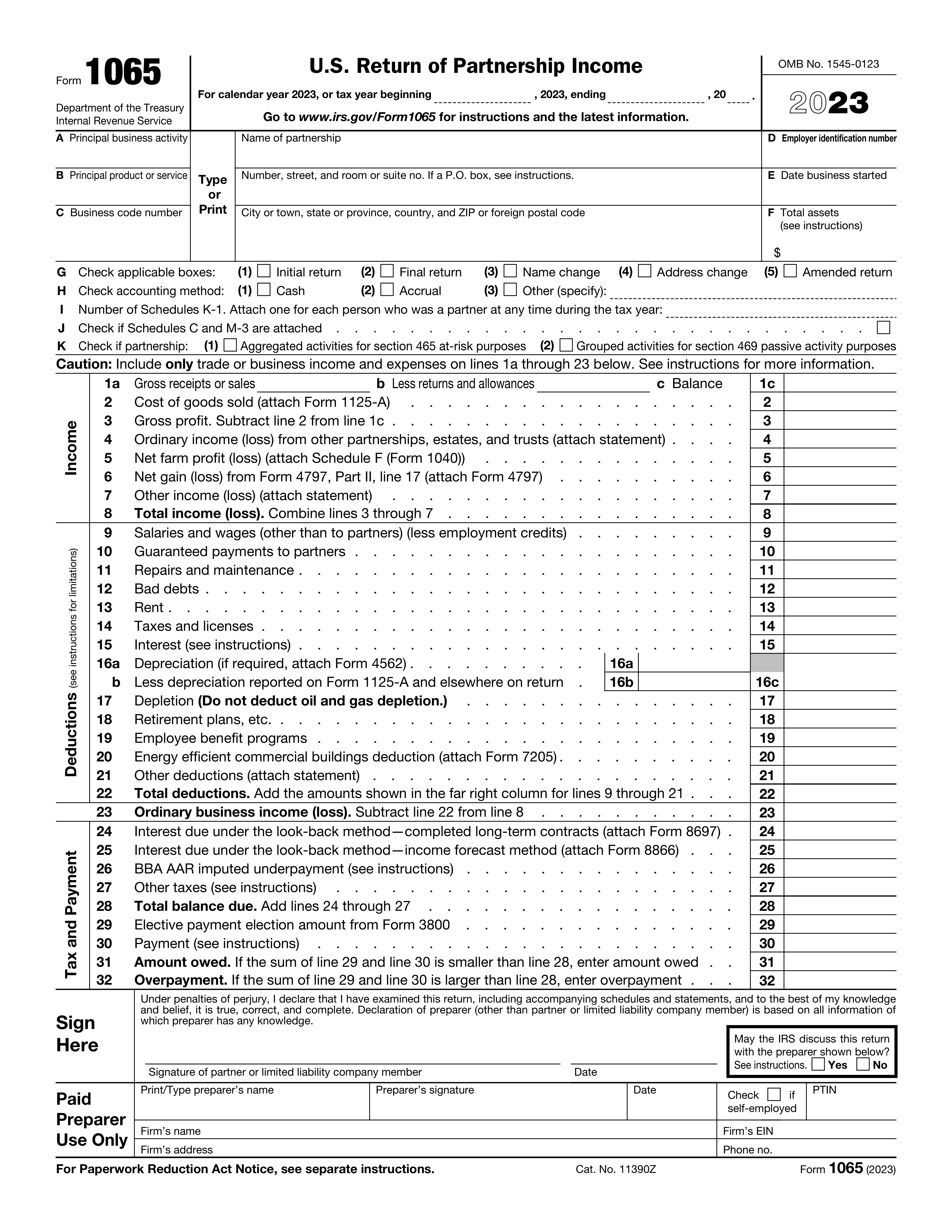

Form 1065, officially known as the U.S. Return of Partnership Income, is a tax document used by partnerships to report their income, deductions, gains, and losses to the IRS. It's crucial for ensuring that the partnership's financial activities are accurately reported for tax purposes, and it helps in determining the tax obligations of the partners.

Our AI automatically handles information lookup, data retrieval, formatting, and form filling.

It takes less than a minute to fill out Form 1065 using our AI form filling.

Securely upload your data. Information is encrypted in transit and deleted immediately after the form is filled out.

Form specifications

| Form name: | Form 1065, U.S. Return of Partnership Income |

| Form issued by: | Internal Revenue Service |

| Number of fields: | 421 |

| Number of pages: | 6 |

| Version: | 2023 |

| Official download URL: | https://stinstafill.blob.core.windows.net/file-uploads/top-forms/irs-1065.pdf?sv=2023-08-03&st=2024-08-20T08%3A48%3A52Z&se=2054-08-20T08%3A48%3A52Z&sr=c&sp=r&sig=BwTakNzJbjCwWpnRziPrMIg5oVAalO1m7LPb27DVuK0%3D |

| Language: | English |

Instafill Demo: filling out a legal form in seconds

How to Fill Out Form 1065 Online for Free in 2025

Are you looking to fill out a IRS-1065 form online quickly and accurately? Instafill.ai offers the #1 AI-powered PDF filling software of 2025, allowing you to complete your IRS-1065 form in just 37 seconds or less.

Follow these steps to fill out your IRS-1065 form online using Instafill.ai:

- 1 Visit instafill.ai and select Form 1065.

- 2 Enter partnership's name and EIN.

- 3 Fill in principal business activity details.

- 4 Report income, deductions, and credits.

- 5 Sign and date the form electronically.

- 6 Check for accuracy and submit the form.

Our AI-powered system ensures each field is filled out correctly, reducing errors and saving you time.

Why Choose Instafill.ai for Your Fillable Form 1065 Form?

Speed

Complete your Form 1065 in as little as 37 seconds.

Up-to-Date

Always use the latest 2025 Form 1065 form version.

Cost-effective

No need to hire expensive lawyers.

Accuracy

Our AI performs 10 compliance checks to ensure your form is error-free.

Security

Your personal information is protected with bank-level encryption.

Frequently Asked Questions About Form Form 1065

Form 1065, U.S. Return of Partnership Income, is used by partnerships to report their income, gains, losses, deductions, credits, and other financial information to the IRS. This form is essential for the IRS to assess the tax obligations of the partnership as a whole, rather than taxing the individual partners directly.

Any domestic partnership with income or loss must file Form 1065. This includes general partnerships, limited partnerships, and limited liability companies (LLCs) that are treated as partnerships for tax purposes. Foreign partnerships engaged in a trade or business within the United States are also required to file this form.

To complete Form 1065, you will need detailed financial information about the partnership, including total income, deductions, credits, and the allocation of these items among the partners. Additionally, you'll need the partnership's employer identification number (EIN), the names and addresses of the partners, and information about the principal business activity and product or service.

The principal business activity is determined by the primary source of income for the partnership. You should select the code that best represents the partnership's main business activity from the list provided in the instructions for Form 1065. The product or service is the main item or service provided by the partnership in its principal business activity.

The employer identification number (EIN) is a unique identifier assigned to the partnership by the IRS. It is used for tax reporting purposes and is essential for the IRS to process the partnership's tax return. The EIN must be included on Form 1065 to ensure that the partnership's financial information is correctly attributed to it.

Total assets are reported on Form 1065, Schedule B, Question 15. You should report the total value of all assets held by the partnership at the end of the tax year. This includes both tangible and intangible assets, such as cash, accounts receivable, inventory, buildings, and equipment. The amount should be based on the partnership's accounting method and the value of the assets as determined under that method.

Form 1065 allows partnerships to use different accounting methods, including the cash method, accrual method, or any other method that clearly reflects income, as long as it is consistently applied. The choice of accounting method affects how income and expenses are reported. Partnerships must choose an accounting method when they file their first tax return and must obtain IRS approval to change their accounting method later.

A Schedule K-1 must be prepared for each partner in the partnership. The number of Schedules K-1 attached to Form 1065 corresponds to the number of partners. Each Schedule K-1 reports the partner's share of the partnership's income, deductions, credits, and other items. The partnership must provide a copy of Schedule K-1 to each partner and file the Schedules K-1 with the IRS as part of Form 1065.

Schedule B of Form 1065 is used to provide additional information about the partnership, including questions about the nature of the partnership's business, the accounting method used, and details about the partners. It also includes questions about foreign transactions and other specific items that may affect the partnership's tax liability. Schedule B helps the IRS understand the partnership's operations and ensures compliance with tax laws.

Income and deductions are reported on Form 1065 through various schedules and lines. The partnership's total income is reported on line 1, and deductions are reported on lines 1 through 20 of the form. Specific types of income and deductions may require additional schedules or forms. For example, rental real estate income is reported on Schedule E, and charitable contributions are reported on Schedule K. The net income or loss is then calculated and allocated to each partner on Schedule K-1.

Form 1065, U.S. Return of Partnership Income, includes several sections related to tax and payments. The main sections include the computation of the partnership's total income, deductions, and the calculation of the partnership's taxable income. Additionally, there are sections for reporting the partnership's credits, payments, and any tax liability. Partnerships must also report each partner's share of income, deductions, credits, etc., on Schedule K-1, which is part of Form 1065.

Foreign transactions on Form 1065 must be reported in accordance with the instructions provided by the IRS. This includes reporting foreign income, foreign taxes paid or accrued, and any foreign financial assets. Specific schedules and forms may be required depending on the nature and amount of the foreign transactions. Partnerships engaged in foreign transactions should consult the Form 1065 instructions and possibly seek professional advice to ensure compliance with all reporting requirements.

The centralized partnership audit regime, established under the Bipartisan Budget Act of 2015, changes how the IRS audits and collects tax from partnerships. Under this regime, the IRS conducts audits at the partnership level rather than at the individual partner level. This affects Form 1065 by requiring partnerships to designate a partnership representative who has the sole authority to act on behalf of the partnership in IRS proceedings. The regime also introduces new rules for calculating and paying any imputed underpayment resulting from an audit.

To designate a partnership representative on Form 1065, the partnership must provide the name, address, and taxpayer identification number (TIN) of the designated representative in the appropriate section of the form. The partnership representative must be an individual with substantial presence in the United States and has the authority to act on behalf of the partnership in all matters related to the centralized partnership audit regime. It's important to choose a representative carefully, as this designation is binding for the tax year and can only be changed under specific circumstances.

Partnerships must report transactions involving digital assets on Form 1065 if they are engaged in activities that include receiving, selling, exchanging, or otherwise disposing of digital assets. The IRS requires detailed reporting of these transactions to ensure compliance with tax laws. This includes reporting the nature of the transactions, the amount of income or loss, and any other relevant details. Partnerships should refer to the latest IRS guidance on digital assets to ensure accurate reporting on Form 1065.

Guaranteed payments to partners are reported on Form 1065, Schedule K, line 4. These payments are also reported on Schedule K-1, box 4, for each partner. Guaranteed payments are amounts paid to a partner for services or the use of capital, which are determined without regard to the income of the partnership. They are deductible by the partnership and must be included in the partner's gross income.

Rental real estate income is reported on Form 1065, Schedule K, line 2. The income should be detailed on Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation, which is attached to Form 1065. This form requires the partnership to report income and expenses for each rental property. The net income or loss from rental real estate is then transferred to Schedule K, line 2.

Capital gains and losses are reported on Form 1065, Schedule D, Capital Gains and Losses, and the net gain or loss is then transferred to Schedule K, line 9a. The partnership must also provide each partner with a Schedule K-1, which includes their share of the capital gains and losses in box 9. The type of capital gain or loss (short-term or long-term) should be specified.

Partnerships with foreign partners must report the income, deductions, and credits attributable to those partners on Form 1065. Additionally, the partnership must provide each foreign partner with a Schedule K-1, which details their share of the partnership's income, deductions, and credits. The partnership may also need to file Form 8804, Annual Return for Partnership Withholding Tax (Section 1446), and Form 8805, Foreign Partner's Information Statement of Section 1446 Withholding Tax, if there is effectively connected taxable income (ECTI) allocable to foreign partners.

Schedule K-3 is used to report a foreign partner's share of income, deductions, and credits from a partnership. It is an extension of Schedule K-1 and provides additional information necessary for foreign partners to comply with U.S. tax laws. To complete Schedule K-3, the partnership must allocate the items of income, deduction, and credit reported on Schedule K-1 to the foreign partner, taking into account any applicable tax treaties and the nature of the income (e.g., effectively connected income, foreign source income). The completed Schedule K-3 must be provided to each foreign partner.

Compliance Form 1065

Validation Checks by Instafill.ai

1

Ensures that the partnership's name, address, and employer identification number (EIN) are accurately entered at the top of the form.

The AI software verifies that the partnership's name, address, and employer identification number (EIN) are accurately entered at the top of Form 1065. It ensures that the name matches the IRS records, the address is current and complete, and the EIN is correctly formatted. This step is crucial for the IRS to identify the partnership correctly. Any discrepancies in this information could lead to processing delays or errors in the partnership's tax return.

2

Confirms that the tax year is correctly indicated by filling in the appropriate dates.

The AI software confirms that the tax year for which the Form 1065 is being filed is correctly indicated by the appropriate dates. It checks that the start and end dates of the tax year are accurately filled in, ensuring they align with the partnership's fiscal year. This validation is essential for the IRS to process the return within the correct tax period. Incorrect tax year information could result in the return being filed for the wrong period, leading to potential penalties.

3

Verifies that the principal business activity, product or service, and the corresponding business code number are specified.

The AI software verifies that the principal business activity, product or service, and the corresponding business code number are accurately specified on Form 1065. It ensures that the business activity description clearly represents the partnership's primary operations and that the correct business code number from the IRS list is used. This information helps the IRS classify the partnership correctly for statistical and regulatory purposes. Accurate classification is vital for ensuring the partnership is subject to the correct tax regulations and benefits.

4

Checks that the applicable boxes for the type of return being filed (e.g., initial, final, amended) and the accounting method used (cash, accrual, other) are correctly marked.

The AI software checks that the applicable boxes for the type of return being filed, such as initial, final, or amended, are correctly marked on Form 1065. It also verifies that the accounting method used by the partnership, whether cash, accrual, or other, is accurately indicated. This validation ensures that the IRS processes the return under the correct filing status and accounting method, which affects how income and expenses are reported. Incorrectly marked boxes could lead to processing errors or the need for amended filings.

5

Ensures that Schedule K-1 is attached for each partner and the number of schedules attached is indicated.

The AI software ensures that Schedule K-1 is attached for each partner in the partnership and that the total number of schedules attached is correctly indicated on Form 1065. It verifies that each Schedule K-1 accurately reflects the partner's share of income, deductions, credits, and other items. This step is crucial for the IRS to ensure that each partner's tax obligations are correctly calculated based on their share of the partnership's income. Missing or incorrect Schedule K-1 attachments could result in discrepancies in the partners' individual tax returns.

6

Confirms that the income section is completed by reporting gross receipts or sales, cost of goods sold, and other income or losses, with necessary forms and statements attached.

Ensures that the income section of Form 1065 is thoroughly completed, accurately reporting all sources of income including gross receipts or sales, cost of goods sold, and any other income or losses. It verifies that all necessary forms and statements related to these income sources are properly attached and referenced. This validation is crucial for the accurate reporting of the partnership's financial activities. It also checks for consistency between the reported figures and the attached documentation to prevent discrepancies.

7

Verifies that allowable expenses, including salaries, guaranteed payments to partners, and other deductions, are accurately deducted, with required forms for depreciation and other deductions attached.

Confirms that all allowable expenses, such as salaries, guaranteed payments to partners, and other deductions, are accurately reported and deducted from the partnership's income. It ensures that the required forms for depreciation and other specific deductions are correctly filled out and attached. This step is essential for the accurate calculation of the partnership's taxable income. It also checks for the proper categorization and documentation of expenses to comply with IRS regulations.

8

Checks that the ordinary business income (loss) is correctly calculated by subtracting total deductions from total income.

Verifies that the ordinary business income (loss) is accurately calculated by subtracting the total allowable deductions from the total income reported. This calculation is critical for determining the partnership's taxable income. The validation ensures that all income and deductions are correctly accounted for in this calculation. It also checks for mathematical accuracy and consistency with the figures reported in other sections of the form.

9

Ensures that any taxes and payments due, including interest under the look-back method and other taxes, are accurately reported.

Ensures that all taxes and payments due, including any interest calculated under the look-back method and other applicable taxes, are accurately reported on Form 1065. This validation is crucial for compliance with tax obligations and to avoid penalties. It checks for the correct application of tax rates and the accurate calculation of any interest or penalties due. Additionally, it verifies that all payments made are properly documented and reflected in the form.

10

Confirms that the form is signed and dated, and the preparer's information is provided if applicable.

Confirms that Form 1065 is properly signed and dated by an authorized individual, and that the preparer's information is provided if the form was prepared by someone other than the taxpayer. This validation is essential for the form's validity and compliance with IRS requirements. It checks that the signature and date are present and that the preparer's information, if applicable, is complete and accurate. This step also ensures that the form is ready for submission and processing by the IRS.

11

Verifies that Schedule B is completed for additional information, including entity type, ownership details, and other required disclosures.

Ensures that Schedule B is accurately completed, capturing all necessary details about the entity type, ownership structure, and any additional disclosures required by the IRS. This validation check confirms that the partnership has provided a comprehensive overview of its legal and operational framework, which is crucial for the IRS to assess the partnership's compliance with tax laws. It also verifies that the information aligns with the partnership's records and other submitted documents. This step is essential for maintaining the integrity and accuracy of the tax return.

12

Checks that Schedule K is filled out to report partners' distributive share items, including income, deductions, credits, and other information.

Confirms that Schedule K is properly filled out, detailing each partner's distributive share of the partnership's income, deductions, credits, and other relevant financial information. This validation ensures that the allocation of profits and losses among partners is accurately reported, reflecting the partnership agreement and applicable tax laws. It also checks for consistency between the amounts reported on Schedule K and the partnership's financial records. Accurate completion of Schedule K is vital for the correct calculation of each partner's tax liability.

13

Ensures that Schedule L for the balance sheet, Schedule M-1 for reconciliation of income per books with income per return, and Schedule M-2 for analysis of partners' capital accounts are prepared.

Verifies that Schedule L, Schedule M-1, and Schedule M-2 are accurately prepared and included with the Form 1065 submission. This validation ensures that the partnership's balance sheet (Schedule L) correctly reflects its financial position at the end of the tax year. It also confirms that Schedule M-1 accurately reconciles the partnership's book income with its taxable income, and that Schedule M-2 provides a detailed analysis of changes in the partners' capital accounts. These schedules are crucial for the IRS to understand the partnership's financial activities and ensure compliance with tax reporting requirements.

14

Confirms that all required attachments and statements are included with the return.

Ensures that all necessary attachments and statements, as specified by the IRS, are included with the Form 1065 submission. This validation check confirms that the partnership has provided all additional documentation required to support the information reported on the tax return, such as statements of income, deductions, and credits. It also verifies that any required disclosures or explanations are properly attached, ensuring a complete and transparent submission. This step is crucial for avoiding delays or requests for additional information from the IRS.

15

Verifies that detailed instructions on specific lines or schedules have been followed by referring to the official IRS instructions for Form 1065 available at www.irs.gov/Form1065.

Confirms that the partnership has adhered to the detailed instructions provided by the IRS for completing specific lines or schedules on Form 1065. This validation ensures that the partnership has followed the latest guidance and requirements, reducing the risk of errors or omissions. It involves cross-referencing the completed form with the official IRS instructions to ensure compliance with tax laws and regulations. This step is essential for maintaining the accuracy and reliability of the tax return, and for minimizing the potential for audits or penalties.

Common Mistakes in Completing Form 1065

Ensuring the partnership name, address, and Employer Identification Number (EIN) are accurately reported is crucial for the IRS to process the return correctly. Mistakes in these details can lead to processing delays or misapplication of payments. Always double-check the EIN against IRS records and ensure the partnership name and address match those on file with the IRS. Utilizing the IRS's EIN Assistant can help verify the correct EIN.

Accurately reporting the tax year dates is essential for the IRS to determine the correct tax period being reported. Incorrect dates can result in penalties or the return being processed for the wrong tax year. Always verify the tax year dates before submission and ensure they align with the partnership's fiscal year. If the partnership operates on a fiscal year basis, clearly indicate this on the form.

Selecting the correct principal business activity and corresponding business code number is vital for the IRS to classify the partnership correctly. An incorrect code can affect the partnership's tax obligations and benefits. Review the North American Industry Classification System (NAICS) codes carefully to find the most accurate description of the partnership's principal business activity. Consulting with a tax professional can also ensure the correct code is selected.

Accurately indicating the type of return and accounting method is critical for the IRS to process the partnership's tax return correctly. Mistakes in these areas can lead to incorrect tax assessments. Review the form instructions to understand the implications of each option and ensure the boxes checked reflect the partnership's actual practices. If unsure, seeking advice from a tax professional can prevent errors.

Providing a Schedule K-1 for each partner is mandatory, as it reports each partner's share of the partnership's income, deductions, credits, etc. Omitting a Schedule K-1 or providing an incorrect number can lead to penalties and processing delays. Ensure that a Schedule K-1 is prepared for every partner, including those who joined or left during the tax year. Double-check the total number of Schedules K-1 against the partnership's records to ensure accuracy.

Accurate reporting of gross receipts, cost of goods sold, and other income is crucial for the correct calculation of a partnership's taxable income. Mistakes in these areas can lead to incorrect tax liabilities and potential penalties. To avoid these errors, partnerships should maintain detailed and accurate financial records throughout the year. Utilizing accounting software or consulting with a tax professional can help ensure that all income and expenses are correctly categorized and reported.

Partnerships often miss out on deductions or incorrectly report allowable expenses, which can significantly affect the taxable income. It's essential to understand which expenses are deductible and to keep thorough documentation of all business expenses. Regularly reviewing IRS guidelines and consulting with a tax advisor can help identify all allowable deductions and ensure they are accurately reported on Form 1065.

The miscalculation of ordinary business income (loss) can lead to discrepancies in the partnership's tax obligations. This mistake often stems from errors in the initial reporting of income and expenses. To prevent miscalculations, partnerships should double-check their calculations and consider using accounting software that automatically calculates these figures. Additionally, having a second set of eyes, such as a tax professional, review the return can catch any errors before filing.

Inaccurate reporting of taxes and payments due can result in underpayment or overpayment of taxes, leading to penalties or refund delays. Partnerships must ensure that all tax liabilities are accurately calculated and reported. This includes understanding the specific tax obligations for partnerships and making estimated tax payments throughout the year. Utilizing tax preparation software or consulting with a tax professional can help ensure accuracy in reporting taxes and payments.

A common oversight is the failure to sign, date, or include the preparer's information on Form 1065, which can render the return invalid. This mistake can be easily avoided by reviewing the form thoroughly before submission to ensure all required fields are completed. It's also advisable to establish a checklist that includes these critical elements to prevent omission. Ensuring that the preparer's information is accurate and up-to-date is equally important for the validity of the tax return.

Failing to provide complete and accurate information on Schedule B can lead to processing delays or penalties. It's crucial to thoroughly review each question and provide detailed responses. Ensure that all applicable sections are filled out, especially those pertaining to foreign transactions and ownership. Regularly consulting the IRS instructions for Schedule B can help avoid common errors and omissions.

Accurate reporting of each partner's distributive share items on Schedule K is essential for correct tax filings. Mistakes often occur in the allocation of income, deductions, and credits among partners. To prevent errors, partnerships should maintain detailed records and use software or professional services that ensure accurate allocations. Double-checking the figures against the partnership agreement and financial statements can also help in identifying discrepancies.

Schedule L, M-1, and M-2 require precise financial information that reflects the partnership's balance sheet and reconciliation of income. Errors in these schedules can result from incorrect data entry or misunderstanding the requirements. It's advisable to reconcile these schedules with the partnership's books and records before submission. Utilizing accounting software that integrates with tax preparation tools can minimize the risk of inaccuracies.

Omitting necessary forms and statements can lead to the rejection of the tax return or additional scrutiny from the IRS. Partnerships must ensure that all required attachments, such as statements of changes in partners' capital accounts or foreign financial asset statements, are included. Creating a checklist based on the current year's filing requirements can help in ensuring that all documents are accounted for and properly attached.

The IRS frequently updates forms and instructions, and using outdated versions can result in non-compliance and penalties. Always verify that you are using the most current form and instructions available on the IRS website at the time of filing. Subscribing to IRS updates or consulting with a tax professional can help in staying informed about the latest changes and requirements.

Saved over 80 hours a year

“I was never sure if my IRS forms like W-9 were filled correctly. Now, I can complete the forms accurately without any external help.”

Kevin Martin Green

Your data stays secure with advanced protection from Instafill and our subprocessors

Robust compliance program

Transparent business model

You’re not the product. You always know where your data is and what it is processed for.

ISO 27001, HIPAA, and GDPR

Our subprocesses adhere to multiple compliance standards, including but not limited to ISO 27001, HIPAA, and GDPR.

Security & privacy by design

We consider security and privacy from the initial design phase of any new service or functionality. It’s not an afterthought, it’s built-in, including support for two-factor authentication (2FA) to further protect your account.

Fill out Form 1065 with Instafill.ai

Worried about filling PDFs wrong? Instafill securely fills irs-1065 forms, ensuring each field is accurate.